About Us

The Guyana Revenue Authority (GRA) was established on January 27, 2000, following the merger of the Inland Revenue and Customs & Excise Departments. These changes were as a result of the passing of the legislation in the Tax Act. The transition has allowed the Revenue Body to continue to evolve its operations and administration, increasing its infrastructure and technical capacity over the years. In its continued pursuit to improve our service delivery and tax administration to the Republic of Guyana, and across the global spectrum, Value Added Tax (VAT) and the Taxpayer Identification Number (TIN), were both introduced, paving the way for greater tax control and data monitoring.

Since the introduction of these two major initiatives, several data management software programmes, including TRIPS followed by the recently introduced ASYCUDA, including several major tax programmes were introduced to further catapult our tax administration organization and initiatives, thereby further improving our revenue targets. Our website provides a plethora of information on these initiatives and tax matters that will aid you in successfully transacting business with the Guyana Revenue Authority (GRA).

Thank you for visiting.

Godfrey Statia

Commissioner – General

Vision

The Vision of the Guyana Revenue Authority is to gain recognition and respect from its clients and other stakeholders, through its integrity and fairness in administering high quality, yet affordable programmes. The Authority’s good standing will be earned though:

- Quality service and client education that meet the needs of our diverse client base;

- Responsible enforcement of the laws based on the application of sound risk management, principles and practices;

- Fair, impartial and timely redress processes;

- Our sensitivity to the effects of administrative and legal requirements we must impose on clients and our efforts to ease the burden and cost of compliance;

- Skilled, knowledgeable and professional people, working in an environment that encourages and supports their personal and professional development; and

- Our commitment to open, transparent and accountable administration.

Mission

The mission of the Guyana Revenue Authority is to promote compliance with Guyana’s Tax, Trade and Border Laws and regulations, through education, quality service and responsible enforcement programmes, thereby contributing to the economic wellbeing of the people of Guyana.

The Core Principles

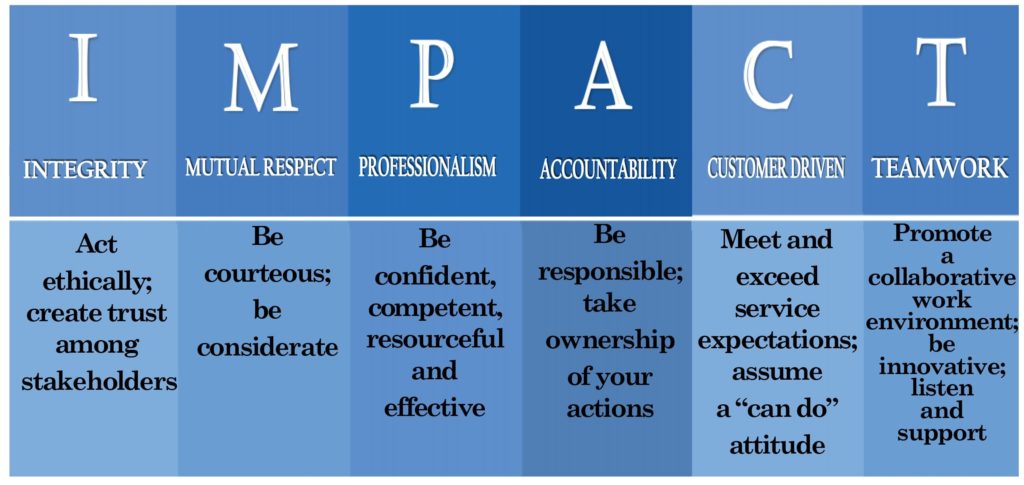

The acrostic IMPACT reflects the fundamental tenets that must permeate the organization to improve its corporate

image, customer service, and human resource quality.